Coinbase CEO Brian Armstrong Sells $1.98 Million Shares

Coinbase, founded in 2012 by Brian Armstrong, is a leading global cryptocurrency exchange platform w…….

Your Cyber Rhythm for Coinbase in Karachi

Stay informed with the fresh Coinbase headlines and movements on coinbase.karachi-pakistan.com. Delve into selected content.

Welcome to an extensive exploration of Coinbase, a revolutionary platform that has transformed the way we interact with digital currencies. In this article, we will embark on a journey through the intricate world of cryptocurrencies, focusing on Coinbase’s role as a cornerstone in this rapidly evolving sector. By the end, readers will gain a comprehensive understanding of Coinbase’s history, operations, impact, and its potential to shape the future of global finance.

Definition: Coinbase is a digital currency exchange platform, serving as a bridge between traditional financial systems and the realm of cryptocurrencies. It facilitates the buying, selling, and storing of various digital assets, commonly known as cryptocurrencies.

Key Components:

Historical Context:

Born out of the need for simplicity and security in the complex world of crypto, Coinbase was founded in 2012 by Brian Armstrong and Peter Thiel. Initially, it aimed to make cryptocurrencies accessible to the mainstream, which was a challenging task given the lack of user-friendly interfaces at the time. Over the years, Coinbase has grown exponentially, expanding its services globally and becoming one of the most popular cryptocurrency exchanges.

Significance:

Coinbase plays a pivotal role in democratizing access to cryptocurrencies, enabling individuals and businesses worldwide to participate in this new asset class. It provides an entry point for newcomers, simplifies complex processes, and offers a secure environment for both casual investors and seasoned traders.

International Reach: Coinbase has transcended geographical boundaries, establishing a strong presence across multiple countries. As of 2022, it serves millions of users worldwide, with operations in over 100 countries. This global footprint has contributed to the mainstream adoption of cryptocurrencies, allowing people from diverse economic backgrounds to participate in this digital revolution.

Regional Trends:

Impact on Local Economies: The influx of cryptocurrency exchanges like Coinbase has sparked economic growth in many regions. It has created job opportunities, fostered innovation, and encouraged the development of supporting industries such as blockchain education and legal services.

Market Dynamics: Coinbase operates within a dynamic market characterized by high volatility and rapid technological advancements. The platform’s success relies on its ability to adapt to market fluctuations and provide users with stable, secure environments for trading.

Investment Patterns: Individuals and institutions alike have shown a growing interest in cryptocurrencies as an alternative asset class. Coinbase caters to both retail and institutional investors, offering various investment products and tools to cater to different risk profiles and preferences.

Economic Systems and Integration: The platform has played a significant role in integrating cryptocurrencies into traditional financial systems. By enabling fiat currency deposits and withdrawals, Coinbase bridges the gap between digital and physical money, facilitating easier entry and exit from the crypto market.

Regulatory Impact: As a compliant exchange, Coinbase contributes to shaping regulatory landscapes. Its adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations sets a standard for the industry, ensuring the platform’s integrity and user protection.

Blockchain Innovation: Coinbase has embraced blockchain technology, the underlying infrastructure of cryptocurrencies, to enhance security and transparency. By leveraging smart contracts and decentralized ledgers, it ensures secure transactions and improved efficiency.

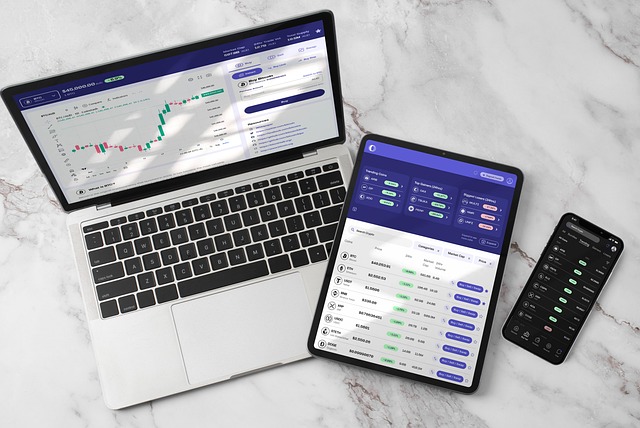

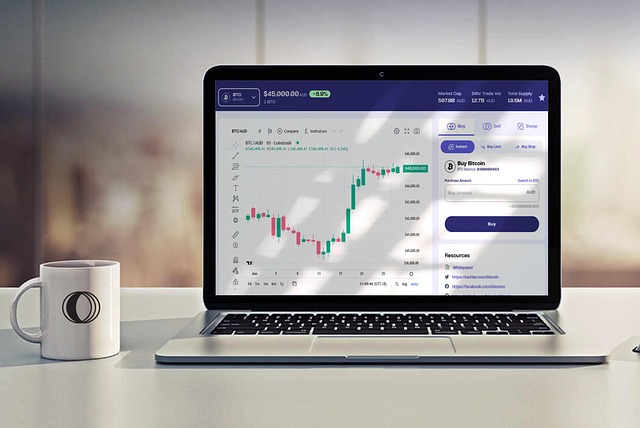

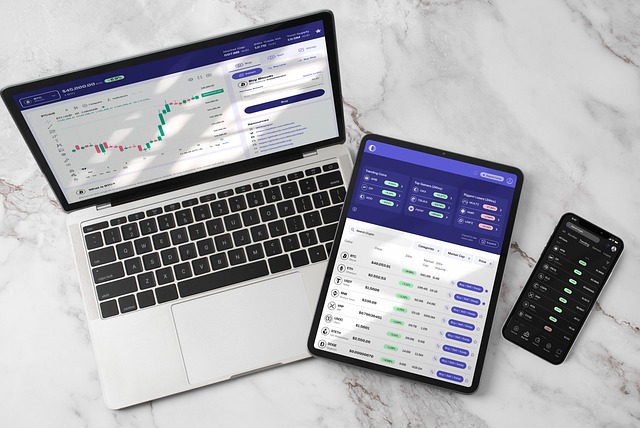

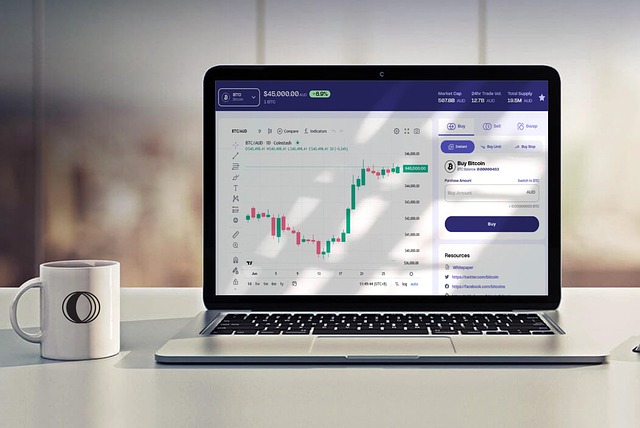

Improved Trading Technologies: The exchange continues to innovate in trading technologies, implementing advanced order types, automated trading tools, and improved pricing algorithms. These features cater to traders’ needs, offering better control and precision in executing trades.

Mobile Integration: Coinbase’s mobile app has revolutionized crypto access on-the-go, allowing users to monitor their portfolios, make transactions, and stay updated with market news from anywhere. This accessibility has played a significant role in expanding the user base.

Future Tech: The platform is exploring emerging technologies like artificial intelligence (AI) and machine learning (ML) to enhance user experience and security. These advancements have the potential to revolutionize risk management, customer support, and fraud detection.

Regulatory Frameworks: Coinbase operates within a complex web of global regulations, with each country imposing its own rules and guidelines. Key regulatory bodies include the Securities and Exchange Commission (SEC) in the US, Financial Conduct Authority (FCA) in the UK, and local financial supervisors in various regions.

Compliance Measures: To maintain compliance, Coinbase employs robust anti-money laundering (AML) and know-your-customer (KYC) procedures, including identity verification, transaction monitoring, and risk assessment. These measures ensure that the platform is not exploited for illicit activities.

Legislative Developments: The evolving nature of cryptocurrency regulations has led to significant legislative developments. For instance, the US passed the Secure Act in 2019, addressing tax and reporting requirements for crypto assets. Coinbase adapts its practices to align with these regulatory changes, ensuring continued operation within legal boundaries.

Global Collaboration: As a global player, Coinbase collaborates with regulators to promote industry-wide standards. It participates in discussions and forums, contributing to the development of best practices and policy frameworks that support innovation while protecting investors.

Security Concerns: Despite robust security measures, cryptocurrency exchanges remain vulnerable to cyberattacks. Coinbase has faced its share of criticism regarding potential vulnerabilities, prompting ongoing efforts to enhance security protocols and user education.

Volatility and Market Manipulation: The highly volatile nature of cryptocurrencies can be a double-edged sword. While it offers opportunities for significant gains, it also exposes users to substantial risks. Coinbase is working on tools to combat market manipulation and provide better price discovery mechanisms.

Regulatory Uncertainty: The fast-changing regulatory landscape presents challenges for Coinbase and the industry as a whole. Unclear guidelines and differing interpretations of crypto regulations across regions can create uncertainty for both users and businesses.

Solving Critical Issues:

Case Study 1: Japan’s Coincheck Incident

In 2018, Japan’s leading cryptocurrency exchange, Coincheck, suffered a significant hack, leading to the loss of millions of dollars’ worth of user funds. Coinbase, with its robust security measures and transparent practices, emerged as a trusted alternative for Japanese users displaced by this incident. Many customers transferred their assets to Coinbase, highlighting the platform’s resilience and reliability.

Case Study 2: Empowering Small Businesses in Africa

Coinbase has played a pivotal role in empowering small businesses in Africa through cryptocurrency adoption. In Kenya, for instance, a local coffee shop owner used Coinbase to accept crypto payments, attracting tech-savvy customers and expanding his business reach. This case study demonstrates how Coinbase facilitates financial inclusion and fosters economic growth.

Case Study 3: Institutional Adoption with Gemini

Coinbase’s sister company, Gemini, has been at the forefront of institutional adoption. They partnered with major financial institutions to provide them with a secure platform for trading and managing crypto assets. This strategy has attracted substantial institutional investments, signaling the growing confidence in the cryptocurrency market.

Growth Areas:

Emerging Trends:

Strategic Considerations:

Coinbase has emerged as a dominant force in the cryptocurrency space, transforming how people interact with digital currencies. Its commitment to security, user-friendly interfaces, and regulatory compliance has set new standards for the industry. As the crypto ecosystem continues to evolve, Coinbase’s role becomes increasingly critical in fostering adoption, innovation, and financial inclusion.

By addressing challenges head-on, embracing technological advancements, and staying attuned to global trends, Coinbase is well-positioned to shape the future of digital currencies. The platform’s impact extends beyond borders, contributing to a more inclusive, transparent, and efficient global financial system.

Q: Is Coinbase safe for storing my cryptocurrency?

A: Yes, Coinbase employs industry-leading security measures to protect user funds and data. They use encryption, multi-factor authentication, and regular security audits to ensure a secure environment.

Q: How do I get started with investing in cryptocurrencies through Coinbase?

A: Creating an account is the first step. Once registered, you can fund your wallet using various methods, explore available cryptocurrencies, and start trading or purchasing based on your investment goals.

Q: Are there any fees associated with using Coinbase?

A: Yes, Coinbase charges fees for certain services, including trading, withdrawing funds, and converting currencies. These fees vary based on the transaction type and region. The platform provides transparent pricing information to help users understand costs.

Q: Can I trade cryptocurrencies with leverage on Coinbase?

A: Currently, Coinbase does not offer leveraged trading, which means you can only trade with the funds you hold in your account. This approach helps maintain user control and reduces risk but may limit potential profits.

Q: How does Coinbase ensure compliance with regulations?

A: Coinbase adheres to strict regulatory standards by implementing robust AML and KYC procedures, conducting regular security audits, and staying updated with global regulatory changes. They collaborate with regulators to promote best practices in the industry.

Coinbase, founded in 2012 by Brian Armstrong, is a leading global cryptocurrency exchange platform w…….

Coinbase, launched in 2012, has evolved from a Bitcoin exchange to a global leader in cryptocurrency…….

Coinbase, a leading digital currency exchange platform, has become a cornerstone in the cryptocurren…….

Coinbase, a global digital currency exchange leader, employs a multi-faceted strategy to prevent fra…….

Coinbase, as a leading global cryptocurrency exchange, is committed to fostering inclusivity and edu…….

Coinbase, founded in 2012, has rapidly evolved into a global leader in cryptocurrency adoption by of…….

Coinbase, facing unique challenges in the crypto space due to its decentralized nature, employs a mu…….

Coinbase, as a global leader in cryptocurrency services, actively promotes inclusivity within the in…….

Coinbase, a top global cryptocurrency exchange, drives decentralization and financial autonomy by of…….