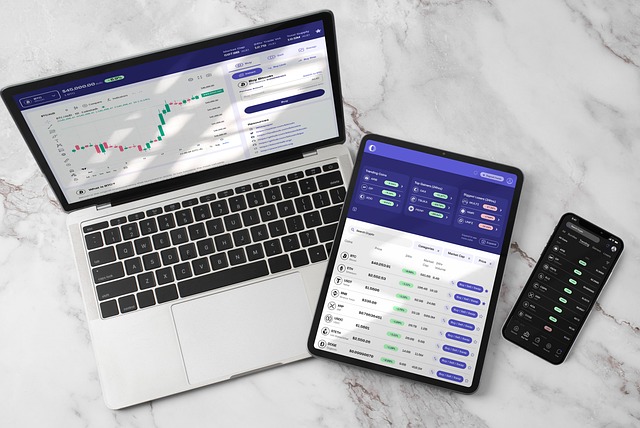

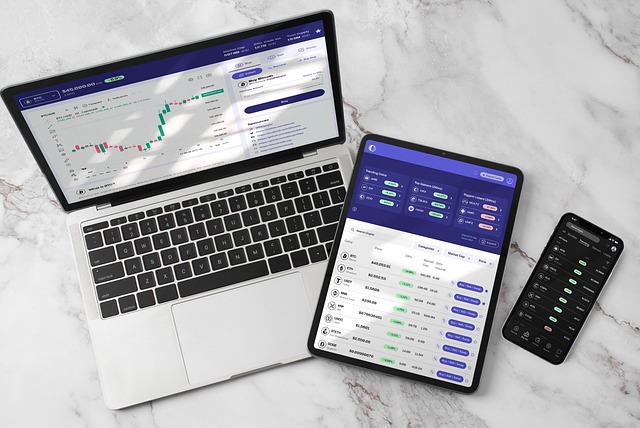

Coinbase, a global cryptocurrency exchange leader, significantly impacts crypto market trends and price movements due to its large market share, high liquidity, and continuous 24/7 trading. As an accessible platform for individuals and institutions, Coinbase drives high trading activities that shape market dynamics. Its efficient trade execution reduces volatility, while global reach attracts investment, fostering growth and stability. Price movements on Coinbase often reflect trader actions, underscoring its pivotal role in the crypto landscape. Through strategic partnerships, robust security, and innovative tools like its API, Coinbase promotes mainstream adoption, enhances trading efficiency, and drives regulatory frameworks for legitimacy in the digital asset ecosystem.

“Coinbase, a leading global cryptocurrency exchange, has left an indelible mark on the digital asset market. This article explores Coinbase’s profound impact on shaping global crypto trends and price movements. From its significant market share to revolutionary API integrations, we analyze how Coinbase facilitates widespread adoption and influences key trends. Additionally, we discuss its role in regulatory frameworks and predict future prospects, offering insights into Coinbase’s enduring influence on the ever-evolving cryptocurrency landscape.”

- Coinbase's Market Share and Its Influence on Crypto Prices

- Facilitating Global Adoption: How Coinbase Shaping the Crypto Landscape

- The Role of Coinbase in Major Crypto Trends Emergence

- Impact of Coinbase's API on Automated Trading and Market Liquidity

- Regulatory Implications: Coinbase's Contribution to Global Crypto Frameworks

- Future Prospects: Predicting Coinbase's Influence on Upcoming Crypto Market Dynamics

Coinbase's Market Share and Its Influence on Crypto Prices

Coinbase, one of the world’s largest cryptocurrency exchanges, has significantly impacted global crypto market trends and price movements. With a substantial market share, Coinbase influences prices through its platform’s liquidity and trading volumes. As one of the most popular and easily accessible crypto exchanges, Coinbase attracts both individual investors and institutional players, driving higher trading activities and ultimately shaping market dynamics.

The exchange’s high liquidity means that buyers and sellers can execute trades quickly and efficiently, reducing price volatility. Moreover, Coinbase’s global reach allows for 24/7 trading, contributing to the continuous flow of capital into the crypto markets. This constant influx of investment has been a key factor in the overall growth and stability of the cryptocurrency market, with price movements often reflecting the collective actions of traders on platforms like Coinbase.

Facilitating Global Adoption: How Coinbase Shaping the Crypto Landscape

Coinbase, a leading cryptocurrency exchange, has played a pivotal role in facilitating global adoption and shaping the crypto landscape. Since its inception, Coinbase has been at the forefront of making cryptocurrencies more accessible to mainstream users by offering a user-friendly platform that simplifies complex trading processes. With operations spanning across numerous countries, it provides a centralized hub for individuals and institutions alike to buy, sell, and store various digital assets.

The platform’s global reach and robust infrastructure have contributed significantly to the growth of the cryptocurrency market. Coinbase’s user-centric approach, coupled with its strategic partnerships, has attracted millions of customers worldwide. By fostering an environment where crypto transactions are seamless and secure, Coinbase has not only democratized access to cryptocurrencies but also influenced price movements through its high trading volumes.

The Role of Coinbase in Major Crypto Trends Emergence

Coinbase, one of the world’s leading cryptocurrency exchanges, has played a pivotal role in shaping major trends and price movements in the global crypto market. As a platform that caters to both individual investors and institutional players, Coinbase has facilitated the easy accessibility and trading of various cryptocurrencies. Its user-friendly interface and robust security measures have attracted millions of users worldwide, contributing significantly to the mainstream adoption of digital assets.

The platform’s influence is evident in the rapid growth and volatility of prominent cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Coinbase’s market depth and liquidity provide a steady environment for traders, allowing for smoother transactions and price discovery. Moreover, its strategic partnerships with various financial institutions and businesses have further emphasized the legitimacy and integration of cryptocurrency into traditional finance, driving the emergence of new trends and investment opportunities in the crypto space.

Impact of Coinbase's API on Automated Trading and Market Liquidity

Coinbase’s API has had a profound impact on automated trading and market liquidity in the global crypto market. By providing developers with easy-to-use tools to interact with its platform, Coinbase has enabled the creation of sophisticated algorithms that can execute trades at speed and scale. This has led to increased automation in trading, allowing participants to take advantage of market opportunities faster than ever before.

The API’s accessibility has also contributed significantly to liquidity. It has attracted a vast number of developers and traders who build and deploy bots designed to constantly buy and sell cryptocurrencies, ensuring there is always a pool of buyers and sellers available. This dynamic increases the depth of the market, reduces price volatility, and improves overall trading efficiency. Coinbase’s API has thus become a key infrastructure element in shaping the future of crypto trading, fostering a more stable and liquid environment for all participants.

Regulatory Implications: Coinbase's Contribution to Global Crypto Frameworks

Coinbase, as one of the world’s largest cryptocurrency exchanges, plays a significant role in shaping global crypto market trends and price movements. Its influence extends beyond mere trading volumes; Coinbase has contributed substantially to regulatory frameworks worldwide. By adhering to and promoting robust compliance standards, the platform has assisted governments and financial watchdogs in better understanding and regulating the complex digital asset ecosystem. This commitment has led to increased legitimacy for cryptocurrencies, enabling more nations to develop comprehensive crypto regulations.

Furthermore, Coinbase’s active participation in policy discussions and collaborations with regulatory bodies has facilitated the creation of standardized guidelines for cryptocurrency exchanges. These frameworks often include anti-money laundering (AML) protocols, know-your-customer (KYC) measures, and tax reporting requirements, which are essential for maintaining market integrity and consumer protection. As a result, Coinbase’s efforts have not only stabilized the crypto market but also paved the way for wider adoption of digital assets by institutional investors and traditional financial institutions.

Future Prospects: Predicting Coinbase's Influence on Upcoming Crypto Market Dynamics

As one of the largest and most influential cryptocurrency exchanges globally, Coinbase’s actions can significantly shape the future trajectory of the crypto market. Looking ahead, several factors suggest that Coinbase will continue to play a pivotal role in setting global trends. With its massive user base and robust platform, Coinbase is well-positioned to facilitate increased adoption and integration of cryptocurrencies into mainstream finance.

Predictably, upcoming developments such as the launch of new trading pairs, expanded market accessibility, and enhanced security measures could further solidify Coinbase’s dominance. Moreover, its strategic partnerships with various institutions and financial giants may lead to more stable and regulated crypto markets, attracting both individual investors and institutional money. This potential evolution could result in reduced volatility and increased legitimacy for cryptocurrencies, opening doors for wider acceptance as a viable investment and payment option worldwide.

Coinbase, as a leading crypto exchange, significantly influences global market trends and price movements. Its substantial market share and robust API have facilitated widespread adoption, driven liquidity, and shaped major crypto trends. Regulatory implications are evident in its contributions to international frameworks, and future prospects suggest continued dominance, especially with upcoming market dynamics. Coinbase’s impact is undeniable, solidifying its role as a pivotal player in the global cryptocurrency landscape.